AI quality in GCC tax systems has become a central focus for tax and finance leaders across the Gulf region. A new study by Deloitte Middle East surveyed 649 tax and finance professionals across Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait. The findings show that organizations are prioritizing accuracy and analytical reliability over speed or automation when deploying generative AI tools.

The research highlights how AI adoption is progressing unevenly across the region. Many organizations remain cautious as they evaluate risks related to data quality, compliance, and governance.

Why AI Quality in GCC Tax Systems Matters

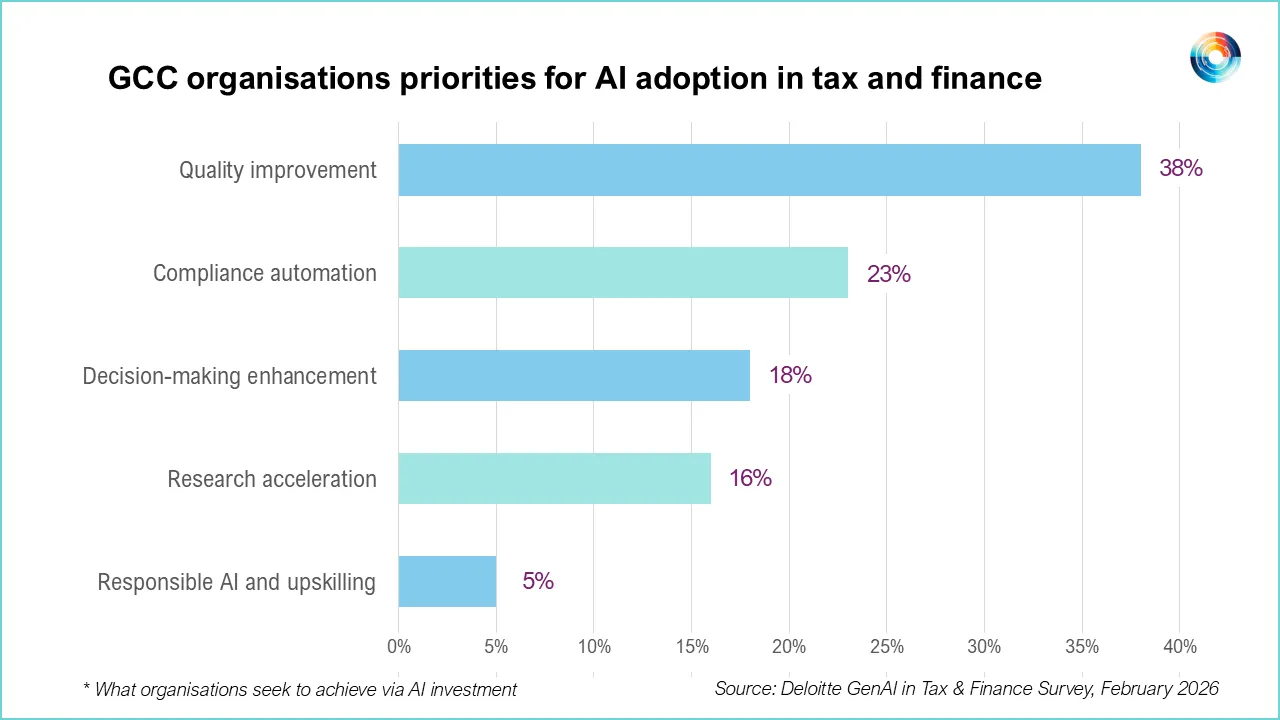

The survey found that 38% of respondents ranked improving analytical quality as the primary objective for using generative AI. This ranked higher than efficiency gains, automation, or cost reduction. Leaders reported that accuracy in tax analysis and reporting remains the most critical requirement.

Compliance automation followed as the second priority at 23%. Decision support accounted for 18%, while research acceleration represented 16%. Only 5% identified responsible AI and workforce upskilling as their main focus.

Adoption Stages of AI Quality in GCC Tax Systems

Organizations were grouped into three categories based on maturity. The early-stage majority, representing 63%, is still exploring or preparing for AI adoption. The scaling and maturity group, accounting for 19%, has deployed AI tools at an enterprise level. The remaining 18% fall into an implementation gap, where pilot programs exist but have not scaled.

Additionally, 29% of organizations reported no active AI initiatives. Another 34% are focused on training, experimentation, or infrastructure preparation.

Data Challenges Affecting AI Quality in GCC Tax Systems

Data fragmentation remains the most significant barrier. 51% of respondents identified problems related to data recording, validation, and reconciliation. These issues increase manual workload and limit AI effectiveness.

Current tools in use include Microsoft Copilot, ChatGPT, email automation tools, and data analytics platforms. However, deployment remains largely experimental rather than operational at scale.

The report concludes that strengthening data foundations is essential before broader AI deployment can occur across GCC tax functions.

Source: https://www.middleeastainews.com/p/gcc-tax-leaders-prioritise-ai-quality