If you have been eyeing PayPal Holdings (PYPL) for your portfolio, the latest news might have made you sit up and take notice. PayPal just announced a multiyear strategic partnership with Google, aiming to weave AI shopping experiences throughout their platforms and expand payment processing integrations. Both companies are positioning this collaboration as a leap forward in digital commerce, with PayPal’s trusted payment infrastructure powering more seamless transactions and Google’s AI capabilities enhancing personalization for consumers and businesses alike.

This announcement comes as PayPal has kept the momentum going with new peer-to-peer payment tools and initiatives to boost user engagement, including PayPal links and global wallet interoperability. While these product rollouts signal a focus on innovation, the stock price tells a different story. PayPal shares are down around 21% so far this year and have slipped 11% over the past twelve months, reflecting continued skepticism in the market. Despite some short-term rebounds and promising signals in customer adoption, momentum has yet to spark a longer-term turnaround.

With this fresh partnership and PayPal’s flurry of product launches, are investors staring at a potential value play, or is the market already baking in the company’s future growth prospects?

Most Popular Narrative: 35% Undervalued

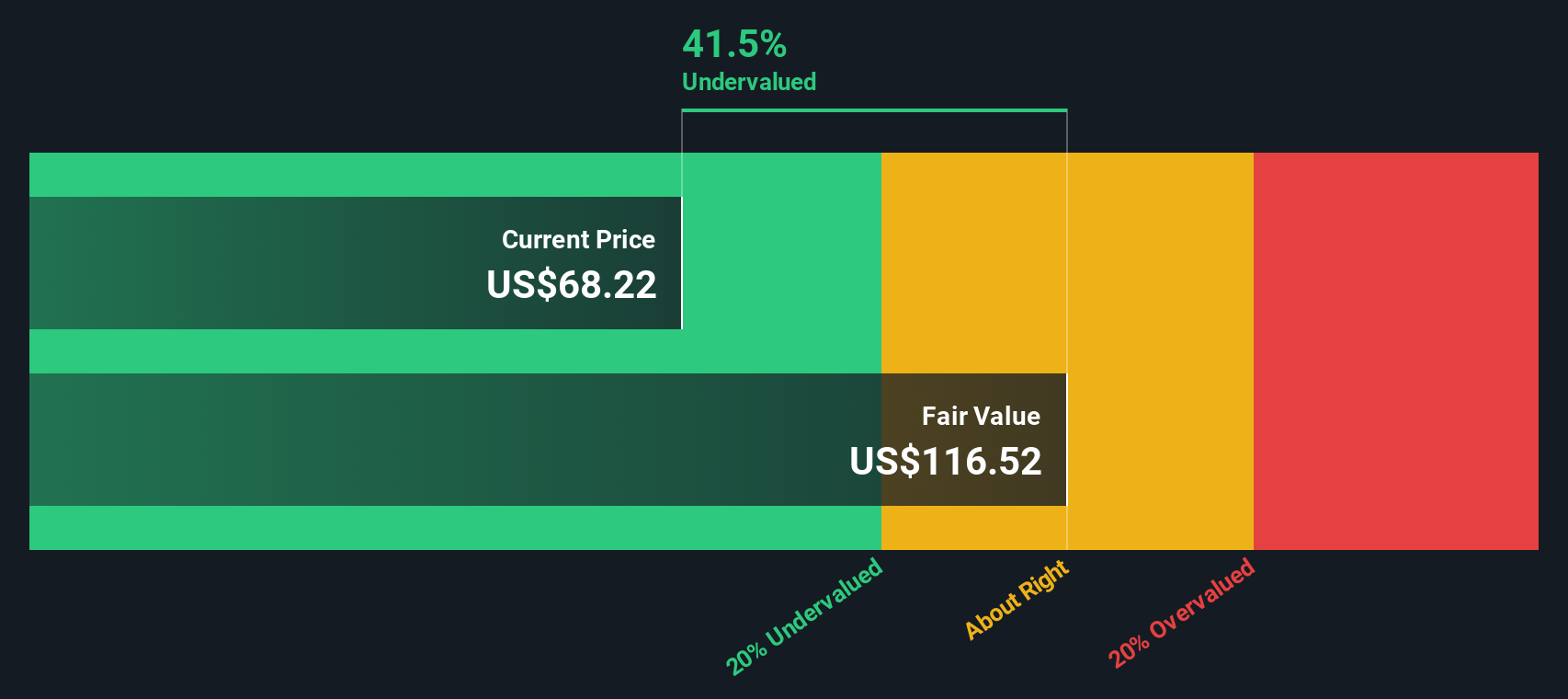

According to Zwfis, the prevailing narrative views PayPal as significantly undervalued, with a fair value estimate much higher than its current market price.

Venmo is a very popular app and tool that people are using all over. One thing that previous management had issues with was how to monetize it. Slowly, besides transaction fees and earning interest off of customers’ unused cash, they have started to add a debit and a credit card into the mix. Along with that, and what I am most optimistic about is how they are making Venmo usable in stores. For example, the other day when I was on DoorDash, I noticed that Venmo is now an option to use for payment. They already made a very simple process begin to spread into the merchant business, which I believe will bring in a lot of revenue while raising profit margins.

Want a glimpse into the numbers fueling this bold undervaluation call? The big narrative hinges on ambitious profit growth, clever platform expansion, and a potential future upside that is turning heads. Curious about how a few highly specific growth levers could drive major upside? This is one calculation you will not want to miss.

Result: Fair Value of $105.25 (UNDERVALUED)Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent competition from other fintech providers and the risk of slower than expected user growth could challenge the optimistic outlook for PayPal’s future.Find out about the key risks to this PayPal Holdings narrative.

Another View: DCF Valuation Reinforces Undervaluation

Our SWS DCF model closely examines PayPal’s future cash flows and arrives at the same conclusion as the first approach, indicating the stock is undervalued at current prices. Does this add support to the case or does it underscore how subjective forecasts can be?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PayPal Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own PayPal Holdings Narrative

If these perspectives do not quite align with your own, you can examine the data firsthand and shape your own narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding PayPal Holdings.

Looking for More Opportunities Worth Your Attention?

Expand your horizons and gain an edge by exploring other strong contenders that could fit your goals and investing style. There are powerful ideas you simply should not overlook.

- Spot income potential and secure steady returns as you browse companies offering impressive yields through our dividend stocks with yields > 3%.

- Ride the momentum of groundbreaking innovation by checking out firms at the forefront of AI technology with the AI penny stocks.

- Capitalize on value by targeting stocks with healthy fundamentals that may be trading below their intrinsic worth with the help of our undervalued stocks based on cash flows.

Source: https://simplywall.st/