JFrog Investment Narrative Recap

To be a shareholder in JFrog, you have to buy into the idea that trusted software supply chain automation and security will become indispensable as enterprises rush to manage ever-growing AI and compliance demands. The latest product launches, particularly those centered on AI-driven automation and audit readiness, may reinforce JFrog’s claim as a “system of record” for software releases, a key catalyst as larger deals and regulatory scrutiny intensify, but do not materially reduce the central risks tied to enterprise sales cycles and potential customer concentration.

Of the recent announcements, JFrog AppTrust stands out as directly relevant to these themes, rolling out advanced compliance automation and evidence systems while tapping into a broader partner ecosystem. This move strengthens JFrog’s appeal for organizations under pressure to rapidly certify complex releases, bridging the gap between development agility and the rigorous security controls expected by regulators and large customers.

However, despite this momentum, investors should still account for the risk that highly concentrated enterprise deals could …

JFrog’s narrative projects $736.3 million in revenue and $96.4 million in earnings by 2028. This requires 15.8% yearly revenue growth and a $182.7 million earnings increase from the current earnings of $-86.3 million.

Exploring Other Perspectives

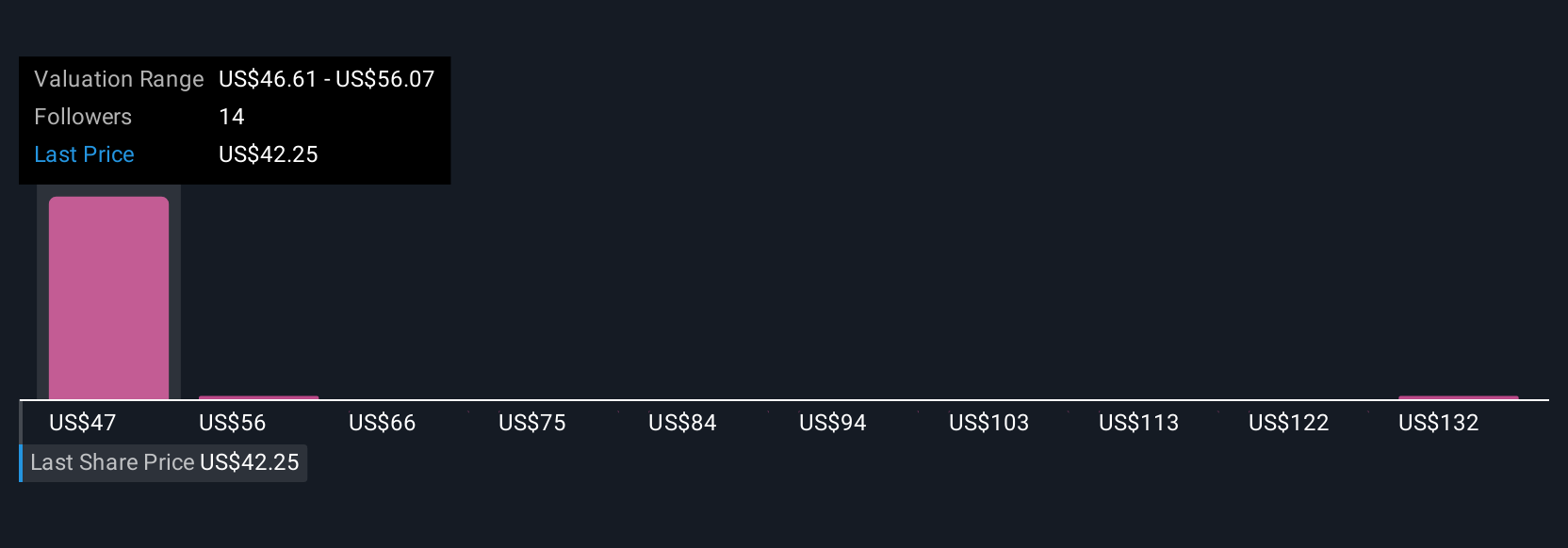

Four individual fair value estimates from the Simply Wall St Community range from US$29.78 to US$141.21 per share. As you compare these valuations, remember that larger enterprise sales and multiyear contracts could increase earnings volatility and affect confidence in JFrog’s outlook, so it’s worth seeing how other investors are weighing the trade-offs.

Explore 4 other fair value estimates on JFrog – why the stock might be worth 40% less than the current price!

Build Your Own JFrog Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your JFrog research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free JFrog research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate JFrog’s overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Source: https://simplywall.st/