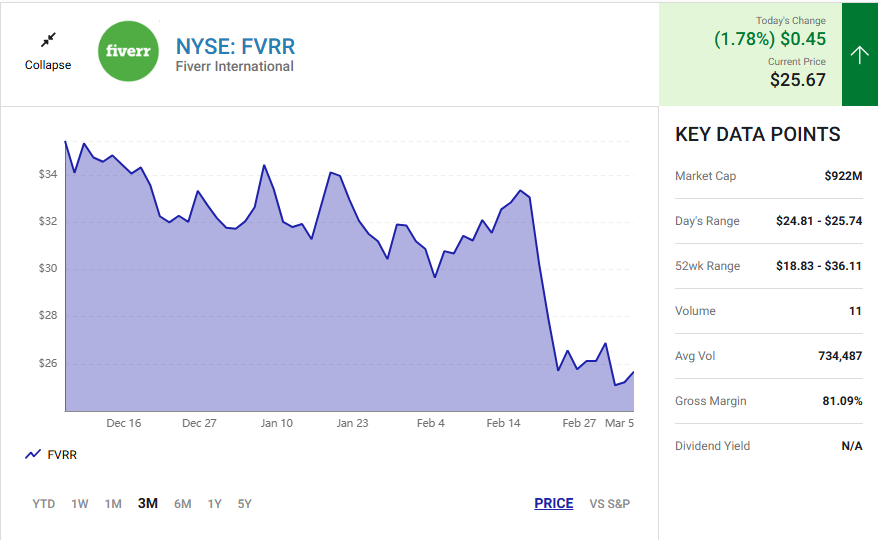

Fiverr International (FVRR 1.78%) held its fourth-quarter 2024 earnings call on February 19, 2025. The freelancing platform delivered 13% revenue growth and achieved a 20% adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) margin, demonstrating solid execution amid continued pressure on small business spending.

Services Revenue Growth Accelerates While Marketplace Stabilizes

Fiverr’s new revenue breakdown shows impressive growth in its services segment, providing a clearer picture of the company’s evolution beyond its traditional marketplace model.

Services revenue was $88.4 million, representing year-over-year growth of 62%, driven by continued strength in Fiverr Ads, Seller Plus, and AutoDS. Services revenue represents 23% of our total revenue in 2024, up from 15% in 2023.

— Ofer Katz, President and CFO

For the full year 2024, marketplace revenue was $303.1 million, driven by 3.6 million annual active buyers with $302 annual spend per buyer. Although active buyer growth remains constrained by macroeconomic conditions, the company expects services revenue to continue growing at a healthy double-digit rate in 2025, with contribution to total revenue reaching over 30%.

Fiverr Go Platform Reimagines AI’s Role in Creative Work

Fiverr has launched its approach to generative AI with Fiverr Go, which aims to maintains human creators at the center of the creative process while leveraging AI to enhance productivity.

Different from other AI platforms that often exploit human creativity without proper attribution or compensation, Fiverr Go is uniquely designed to reshape this power dynamic by giving creators full control over their creative process and rights. It also enables freelancers to build personalized AI models without the need to collect training data sets or understand AI engineering, thanks to Fiverr’s unparalleled foundation of over 6.5 billion interactions and nearly 150 million transactions on the marketplace.

— Micha Kaufman, Co-Founder, CEO, and Chairman

The platform initially covers 60 categories with an open developer ecosystem where third parties can build specialized AI applications that leverage Fiverr’s transaction dataset. Developers earn revenue when their applications are used, creating a system in which AI enhances rather than replaces human creativity.

Upmarket Strategy Shows Resilience Amid Macro Headwinds

Fiverr’s focused efforts on attracting higher-value clients and projects is delivering measurable results despite broader economic challenges.

While the overall active buyers are not growing due to macro headwinds, it is worth noting that buyers with annual spend of over $10,000 continued to show resilient growth. We are also seeing larger and more complex projects show robust growth, with GMV from projects of over $500 growing 8% year over year in 2024 compared to 2023.

— Ofer Katz

The company’s investments in Fiverr Pro, Dynamic Matching, and hourly based services are helping drive higher average spend per buyer. Dynamic Matching is showing particularly strong results, with conversion rates 3-4 times higher than the traditional marketplace, providing stability even as smaller buyers remain cautious.

Looking Ahead

Management expressed confidence in Fiverr’s positioning for 2025, with a clear path to continue delivering on its “Rule of 30” goal (combined revenue growth and EBITDA margin of at least 30%).

As Micha Kaufman emphasized, “With the depth and breadth of data we have, the expansive scale of categories, buyers and sellers we cover and the deep technological expertise we have built over the years, we can empower a robust ecosystem of humans and AI that deliver beautiful results for customers while supercharging freelancers’ earning power.”

Should you invest $1,000 in Fiverr International right now?

Before you buy stock in Fiverr International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fiverr International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Source: https://www.fool.com/